$200B stolen, splurged on Lamborghinis and bling

Tens of thousands of fraudsters splurged on Lamborghinis, vacation homes, private jet flights and Cartier jewelry by fleecing the PPP loan system in a $200 billion heist — and did it because the COVID loan scheme was so easy to milk.

Approximately $1.2 trillion was rushed through Congress in 2020 and 2021 in COVID bailout cash for businesses and spent on the Economic Injury Disaster Loan (EIDLP) and the Paycheck Protection Program (PPP) schemes.

But now a new report from the Small Business Administration’s Office of Inspector General reveals an astonishing 17% vanished to fraud — an estimated total of $200 billion.

And the SBA says it estimates there are more 90,000 “actionable leads,” while it has already prosecuted dozens — including the former New York Jets wide receiver, Josh Bellamy.

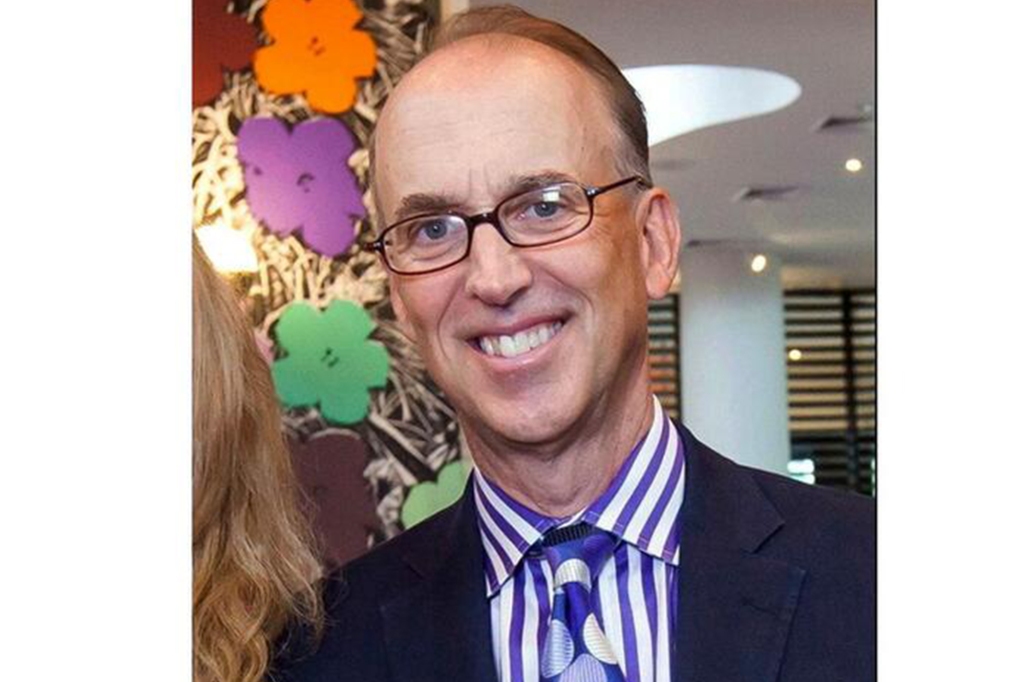

The spending spree on taxpayer dollars includes Donald Finley, owner of the now shuttered Manhattan theme restaurant Jekyll & Hyde, who purchased a Nantucket home across from Dionis Beach with waterfront views with millions of dollars from the Paycheck Protection Program (PPP) and Economic Injury Disaster Loan Program (EIDLP).

Finley faces up to 30 years in prison, and paying more than $3.2 million in restitution, plus a $1.25 million fine.

And experts say crooks created fake businesses or lied about their numbers of employees to get access to more free cash — because it was so simple to fleece the taxpayer.

“The fraud was so easy to commit. All of the information was self-reported and none of it was verified or checked,” Haywood Talcove of LexisNexis Risk Solutions told The Post.

“During the height of the pandemic it was really hard to purchase [luxury] items like a Rolls Royce, or a high end Mercedes because you had people walking in with cash from the PPP program to purchase those items for whatever the dealer was asking,” Talcove said.

Justice might finally be catching up with some of the fraudsters: A total of 803 arrests have taken place as of May 2023 for pandemic fraud, the SBA said.

$30,000 for ‘Mom’

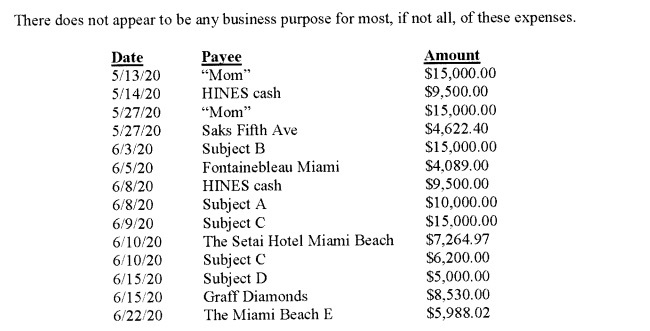

Florida-based David Hines, 29, from Miami used $3.9 million in PPP money to buy himself $318,000 Lamborghini Huracan Evo sports car.

The gassed-up fraudster was caught when authorities seized the sports car and $3.4 million from bank accounts. He pleaded guilty to one count of wire fraud. Records show he spent thousands at high-end shops, a Miami hotel and sent $30,000 of taxpayer cash to “mom.”

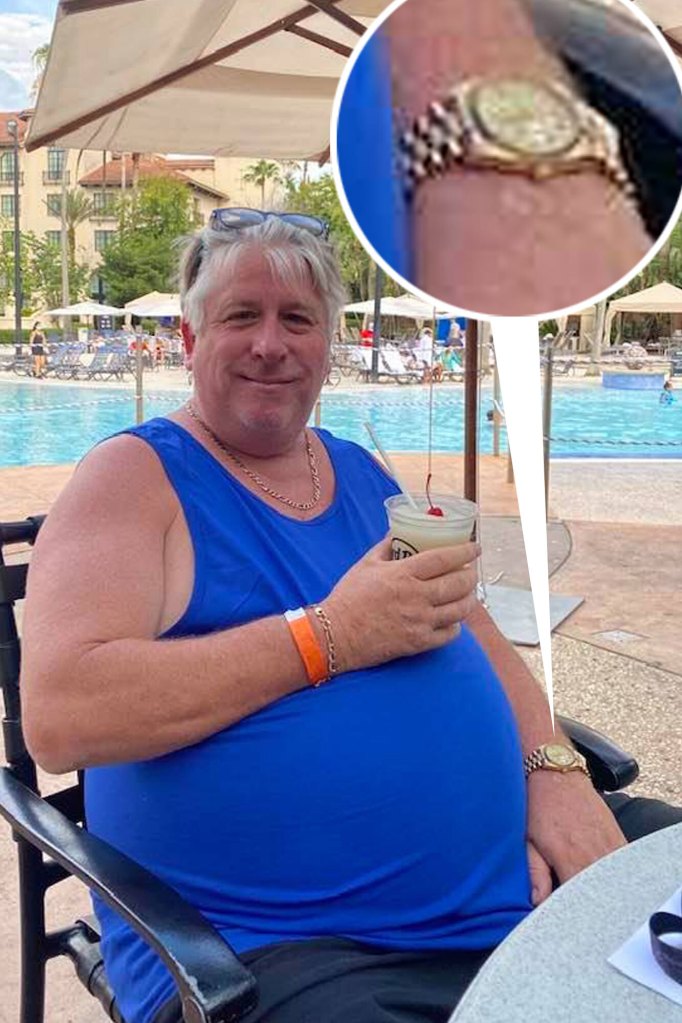

In Jacksonville, Fla., Kenneth Landers, pleaded guilty to fraud in February after using PPP funds totaling $910,000 to pay off his mortgage at home and at his business property.

Vintage Car, Gold Rolex

But then he shelled out for an 18-carat gold Rolex watch and vintage Jaguar XK-E, or E-Type, Roadster. He made a staggering $113,000 in cash withdrawals traced back to the PPP loans received. Landers faces a maximum penalty of 30 years in federal prison.

In similar expensive taste on tax payer money, Georgia-based Darrell Thomas was sentenced to 15-years in prison for spending PPP funds on a Mercedes-Benz S-Class, a Land Rover and Acura NSX in addition to a gold Rolex.

Thomas, pleaded guilty to conspiracy to committing bank fraud and to money laundering for heading a scheme to obtain 14 fraudulent loans amassing $11.1 million from the PPP.

Restaurant Scammer who also Bars Dogs

In April, Manhattan restaurateur Besim Kukaj was revealed to have scammed $6.1 million in bogus loans to his restaurant group.

He owned Manhattan’s Intermezzo, Limon Jungle and Cara Mia, which are all now closed. But officials said he splurged on designer jewelry and clothing.

“He did this out of pure greed, sending some of this money to a Florida real estate developer and using it to buy luxury items from Cartier and Hugo Boss,” Damian Williams, US Attorney for the Southern District of New York said.

“And he didn’t stop there. He directed his co-conspirator to physically threaten a victim to whom he owed money.”

The relentless fraudster pursued pandemic aid even after getting arrested and released on bail, the prosecutor said. Kukaj, whose restaurants previously barred diners with service dogs from entering, started a 6 year, 8 month sentence at Fort Dix federal prison in New Jersey Tuesday.

Plastic Surgery and Luxe Travel

In February, Leslie Bethea, of Surgoinsville,Tennessee, was sentenced to 78 months in prison for fraudulently obtaining a $20,805 loan in 2021.

She had claimed she was due the money because she had lost out on her 2019 income of more than $90,000 because of the pandemic. But that was impossible, because she was in prison in 2019 for fraud, prosecutors said.

Bethea used the scammed cash to fund a five-day trip at a resort in Sunny Isles Beach Florida, according to court records.

She also used some of the dough for vanity — paying for a plastic surgery during her trip. What she got done was not revealed by prosecutors.

And in April, Houston man Scott Jackson Davis was sent to prison and ordered to pay back $3.3 million after fraudulently receiving PPP loans for three fake businesses.

Instead of saving people’s jobs, he splurged on private jet travel, real estate, jewelry guns and a luxury vehicle, prosecutors said.

Ex-Jet Received Your Cash

Former NFL player Josh Bellamy obtained a $1.2 million loan for his company, Drip Entertainment LLC, in 2021 using falsified documents and false information.

Bellamy — a Jets wide receiver from March 2019 until he was released because of injury in September 2020 — admitted to using the loan to fund a stay at the Seminole Hard Rock Hotel and Casino in Hollywood, Fla., and jewelry, admitting to investigators he shelled out more than $311,000 to a reported co-conspirator.

He was released from federal prison in June after serving most of his 37-month sentence.

Read the full article Here