Trumps claimed negative income in four of six years between 2015 and 2020: report

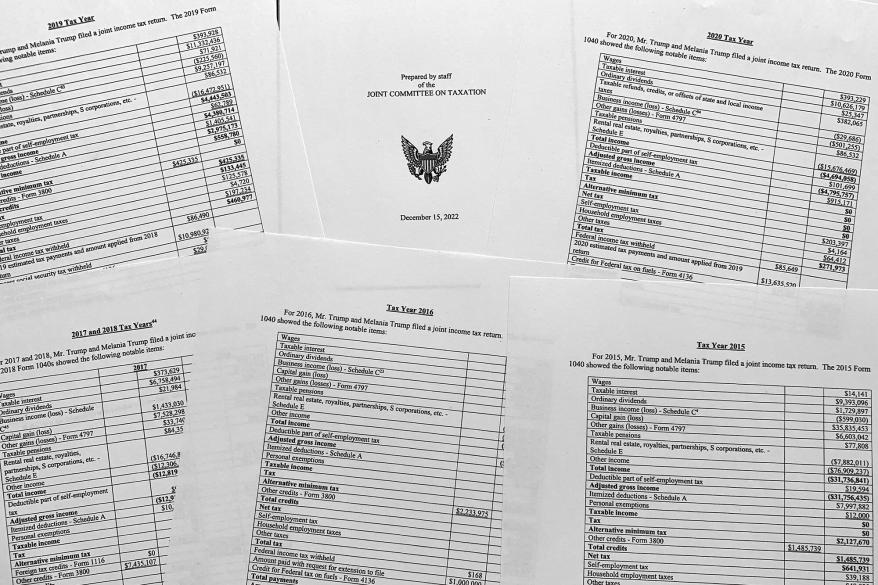

The tax returns of former President Donald Trump and his wife Melania show they reported negative income in four of the six years between 2015 and 2020.

In three of those years — 2015, 2016, and 2017 –the Trumps reported income tax liability of just $750 or less, a report from the House Ways and Means Committee revealed.

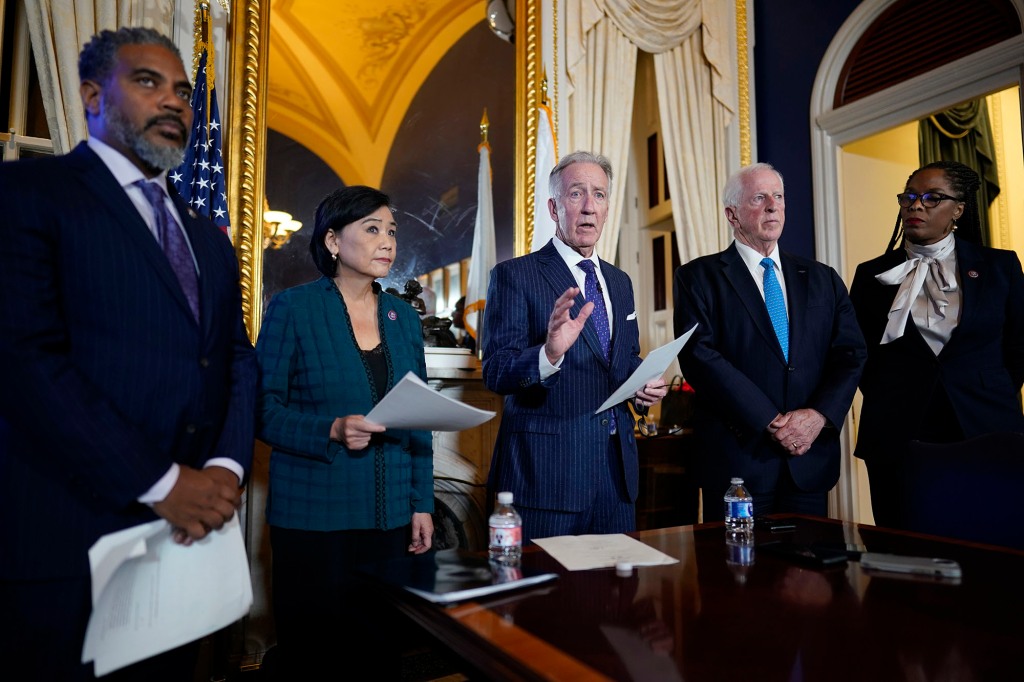

The Democrat-controlled panel voted 24-16 along party lines Tuesday evening to release Trump’s tax returns following a legal battle that began in 2016.

The full release of the returns is expected in the coming days after all personal information is redacted from them.

In the six-year period covered by the returns, the Trumps’ adjusted gross income totaled negative $53.2 million, and their total federal tax liability, including self-employment and household employment taxes, was $4.4 million.

The Trumps reported positive adjusted gross income in only two of those six years — $24.3 million in 2018 and $4.4 million in 2019.

After 2017, the then-first couple’s tax bill increased, the report found, with the Trumps paying almost $1 million in taxes in 2018 and $133,445 in 2019.

In 2020, as the coronavirus pandemic raged across the country, the Trumps reported a loss of $4.8 million and paid $0 in federal taxes.

The release of the returns follows a protracted legal fight that began in April 2019 and went all the way to the Supreme Court.

The panel’s 29-page executive summary also shows that the IRS failed to conduct a mandatory audit of Trump’s tax returns during the 45th president’s first two years in office — a requirement dating back to 1977 following a controversy over former President Richard Nixon’s taxes.

The IRS only began examining the former president’s individual tax return for 2015 — the year he announced his presidential run — when committee chairman Richard Neal (D-Mass.) sent a letter to the federal agency on April 3, 2019, seeking information about the returns.

More than five months later, the report says, the agency selected Trump’s 2016 return for a mandatory audit. The individual returns for 2017, 2018, and 2019 were not selected for examination until after the former president had left office.

“The Committee expected that these mandatory audits were being conducted promptly and in accordance with IRS policies,” Neal said in a statement Tuesday. “We anticipated the IRS would expand the mandatory audit program to account for the complex nature of the former president’s financial situation yet found no evidence of that. This is a major failure of the IRS under the prior administration, and certainly not what we had hoped to find.

“But the evidence is clear,” said Neal. “Congress must step in.”

In response to the committee’s probe, Neal has proposed legislation requiring the IRS to conduct an annual audit of each president’s finances. The bill is unlikely to go anywhere, with mere days to go before the end of the congressional session and Republicans taking control of the House on Jan. 3.

Trump, 76, who announced last month that he is running for president in 2024, has refused to release his tax returns, saying they were under IRS audit.

A spokesman for the former president characterized the release of the returns as an “unprecedented leak by lame duck Democrats” in a statement to the Wall Street Journal.

“If this injustice can happen to President Trump, it can happen to all Americans without cause,” Steven Cheung told the newspaper, adding that the full release of the returns will reflect Trump’s success as a businessman.

Democratic members of the committee said the release of the returns was necessary for transparency.

“I voted to reinforce this critical principle: No person is above the law, not even a president of the United States,” committee member Rep. Brendan Boyle (D-Pa.) said.

But Republicans warned that it could set a dangerous precedent.

“Over our objections in opposition, Democrats in the Ways and Means Committee have unleashed a dangerous new political weapon that overturns decades of privacy protections,” Rep. Kevin Brady (R-Texas), the top GOPer on the panel, told reporters.

“The era of political targeting, and of Congress’s enemies list, is back and every American, every American taxpayer, who may get on the wrong side of the majority in Congress is now at risk,” the Texas lawmaker said.

Earlier this month, a Manhattan trial jury found the Trump Organization guilty of criminal tax fraud.

Prosecutors said that the company helped top executives evade income taxes by providing them off-the-book perks like rent, private school tuition, and luxury cars.

Read the full article Here