Americans snubbing stocks for sneakers, video games, purses

Freaking out about the markets? Turns out, there’s an alternative asset class that’s surging even as the indexes are de-fanged: luxury goods.

According to Bordeaux Index, a wine and spirits merchant, whisky prices rose 12% in the first six months of this year; compare that to the 22% slump of the S&P, or the value of gold, which was up just 1%.

Meanwhile, a Credit Suisse report recently showed that handbags are a haven when

inflation’s biting: Chanel purses increase in value by 17% year on year, per the bank’s stats,

and the sector as a whole reliably offers mid-single digit returns.

Meet four savvy investors who pad their stock and bond portfolios with everything from sneakers to video games.

The investment: Birkin bags

A former managing director at capital investment firm Blackstone, Dana Auslander knows exactly where to put your money — and said she’s bagged a deal on purses that’s better than any blue-chip stock.

“I decided to put much of my equity in my Birkins and I’m not ashamed of that. It was a

great investment,” the 49-year-old told The Post “People have so much money in crypto, but there’s nothing tangible there. With a bag, you look at it, and see it, so you’re putting your money behind an asset that’s not that different from real estate.”

Auslander, who lives on the Upper East Side and is a co-founder of Luxus, a luxury fintech firm, bought her first Hermès-made bag in 2005, in London — a reward after a grueling period of work.

“It was Memorial Day, and I went in [to the Hermès boutique]. I remember the process, the way they treated the bag,” she said. “It felt like a commodity, and I knew then there was something about it.

I’m a Capricorn, so I’m very rational, and for me it wasn’t a status symbol, but an

investment — like buying stock in Apple.”

Since then, Auslander estimates she’s spent more than $100,000 on various Birkins from

around the world. Her advice: Try the St Barth’s Hermès boutique, where you can claim back tax as a visitor.

She reckons her current holdings are worth around $250,000, though she’s not averse to a quick flip. “I bought a Birkin Blue Jean 35cm online for $3,000 — it was such a steal that I bought it to flip it,” she dishes. “I sold it for $12,000.”

Today, Auslander’s focusing more on the exotic skin models, like crocodile, as she expects

them to appreciate the most: by around 30-40% or so. “The stock market is not even close to the bottom yet,” she said with a shrug. “This is an asset class, which people don’t quite understand yet. It’s tangible and it’s never gonna lose its value.”

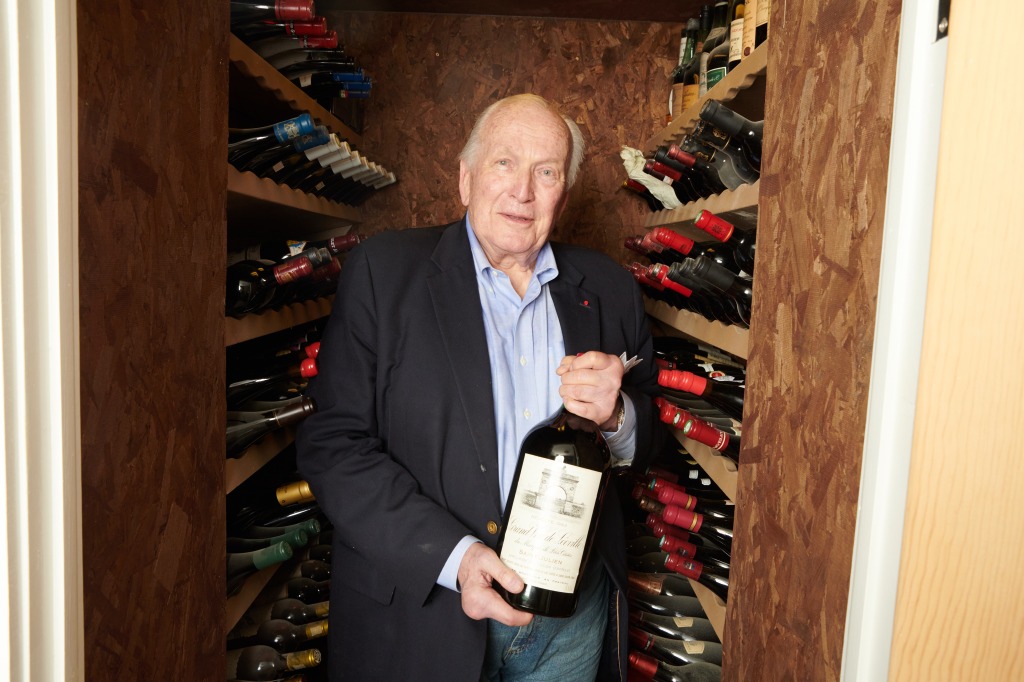

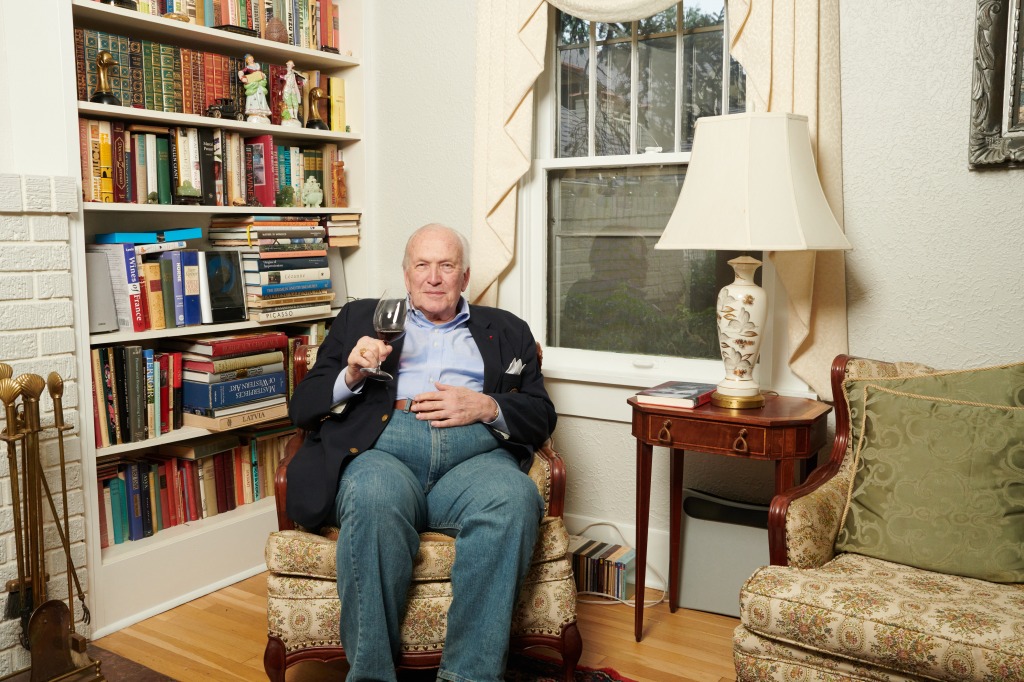

The investment: Fine wine

George Sape got a taste for investing in wine after seeing it outperforming much of the

conventional market.

The 78-year-old, a retired lawyer, was awash with wine from childhood, he said, as his Latvian family would always serve it with supper. But it wasn’t until he went to college that Sape began finessing his bona fides around Beaujolais and co.

In the five decades since, he has seen values skyrocket.

“The escalation in price when I was starting was maybe 5% per year. Now it’s 25-30%, sometimes more,” said Sape, who keeps home in New York and Colorado. “That was like buying Amazon at the ground floor, or Apple — when those shares came on the market? They were, like, twelve bucks.”

He points to Robert Parker’s vintage-rating system, The Wine Advocate, as pivotal: by ascribing a numerical score to a wine, Sape said, it helped finance types compute that wines could be an asset, like any stock.

Handily, the rise of that idea coincided with the rise of greed-is-good Gordon Gekko types, who started buying, drinking and showing off wine for both brag, and investment, value.

Though Sape himself certainly likes to drink his favorites — French reds, mostly — he also

sees his cellar as a backup to the market: He buys and sells via Benchmark Wine, a company that’s expressly set up to help trade pricey bottles in current market conditions.

He just sold around 5,000 to 6,000 bottles that way, and estimates his average ROI was around 30-35%. There are standouts, though. “Time is the element. If you bought a 1961 Petrus in 1965 for $80, it’s worth $5,500 now. You do the math.”

Sape is doubling down on buying more wine now, as “stocks are the worst thing, and equities are suffering dearly.” He also has his eye on the ROI of vintages from Rhone Valley vintages and Languedoc, like Grange des Pères.

“I bought a bunch of that when it was selling for $20 a bottle, and now it’s $400,” he said. “The whole region is riddled with little vineyards making great wine like that which will rise in price as Burgundy and Bordeaux get tapped out.”

The investment: Video games

Last summer, when an unopened Nintendo 64 Super Mario game scored a winning bid of $1.56 million at auction. It didn’t surprise Andrea Angiolillo, who’s been collecting games for five years.

Born and raised in New York City, he has gamed the system to turn a childhood obsession into a lucrative hobby.

“Everyone has been trying to find alternative places to park their money to combat

inflation and stay away from the bear market we’ve endured,” the 26-year-old actor and TikTok personality said.

Angiolillo was still at college when the crypto hype made him wonder what other unexpected assets might be worth exploring. Sifting through the haul of games he’d accrued since he was a kid, he thought: Were they worth anything? Most of his Nintendo 64 games had been used, but mint condition versions were rocketing in price on eBay.

“I bought a couple of my favorite games, which cost a bit more than $500, which as a

college kid was not a super casual purchase,” said Angiolillo, who has had small roles on TV shows like “The Equalizer” and “Quantico.”

Since then, he’s spent up to $5,000 building a collection, which has doubled in price —and he’s increased by about 50% over the past year alone.

“I decided to dedicate a portion of my assets for snagging some more copies of my

favorite games that I feel the most confident with. With all the volatility in markets, I’m

happy to double down on something I have no intention of selling for many years,” Angiolillo said.

He buys multiple copies of well-known games — eight copies of Super Smash Bros, for

example — in CIB (complete in box) condition, a strategy he thinks will future-proof them as assets. Characters that continue to be used in new games will retain their cachet, he

reasons.

And the surge in value for Mario, Donkey Kong, Pokémon and Co. is logical right now,

Angiolillo believes.

“The Nintendo 64 was the popular system from 1996-2002, so all the kids who

grew up with it are now getting to the age where they have more income, and savings, to

look back and own childhood favorites,” he said. “It’s nostalgia and investment combined.”

The investment: Sneakers

Having grown up in Harlem, Thomas Harris recalls the corner of 145th and Broadway “the streetwear capital of the world.”

His parents budgeted for him to have two pairs of sneakers per year, though, so Harris could only unleash his obsession with Air Force Ones and more when he started working.

“I couldn’t afford them as a teenager, so I only became a serious collector when I was around 24, and I quickly amassed 300 pairs of shoes. I’ve probably spent close to $200,000 on them,” Harris told the Post. He’s proudly old school, too. “Sneakers are not supposed to sit on a shelf. I wear them at least once or twice.”

But recently, Harris, who is 42 and now lives in Jersey City, has reallocated some of his stock market money toward sneakers.

His investment’s not in a single ultra-rare pair of kicks; rather, the marketer is buying across a portfolio, via a new company called Rares. It offers shares in six-figure-plus kicks which

can then be flipped once all the shares for a single pair are sold.

When the shoe deal closes, in theory, fractional owners and investors like Harris can look forward to impressive returns; they can also buy and sell those shares in the interim, ideally making a profit in the process.

Harris has shelled out for a share of Nike Air Yeezy One prototypes, which Rares bought for $1.8m at Sotheby’s last year. “It’s the Holy Grail of sneakers, the highest value shoe in the world, that’s why I put my money there,” he said.“I’m picky with the shoes I like.”

Harris is also buying into a pair of black-soled Air Jordan 1s — “one of only four [pairs] that exists in the world” — as well as the Nike & Jay-Z collab from 2010, and the wacky Apple sneakers, produced by Steve Job’ firm as a giveaway for staff.

Still, he isn’t trading his shares, but rather waiting for Rares to start selling the assets. Said Harris of the venture: “It’s only a year and half old, but I’m really excited to see how my investments pay off once they liquidate.”

Read the full article Here