CEOs ‘forced’ into CEI system

Woke, 3-letter alphabet soup policies like ESG and CEI — which are supposedly based on “ethical investing” and are why major American corporations are handing out lucrative endorsements to fringe celebrities like transgender performer Dylan Mulvaney – sound wonky.

But one corporate analyst gave a succinct summation: “You can think about ESG as an attempt to sort of bring critical race theory to the private sector,” said Alison Taylor, executive director of Ethical Systems at New York University.

And like some universities and high schools where parents and administrators have fought back against critical race theory being embedded in the curriculum, America’s big corporations aren’t necessarily as eager to sign on to LGBTQ+, climate or anti-racist policies as you might think – despite the recent rash of endorsements by Nike, Bud Light, Kate Spade of transgender influencer Dylan Mulvaney.

The most controversial of those, by Bud Light, has wiped $5 billion off parent company Anheuser-Busch’s value since March 31, as it deals with the fallout from conservatives over its brand endorsement from the 26-year-old transgender TikTok and Instagram star.

The Post revealed Saturday how companies strive to receive a perfect “Corporate Equality Index” – or CEI – score from the pro-LGBTQ+ lobbying group, the Human Rights Campaign, to comply with progressive policies pushed by the world’s biggest asset funds – pushing them into branding deals like the one with Mulvaney.

But American corporations are being strong-armed into policies that they don’t always agree with by influential non-profit activist groups acting in concert with powerful fund managers, according to Republican presidential candidate Vivek Ramaswamy and other opponents.

They name BlackRock, Vanguard and State Street Corp., which each own up to five percent of most major US companies, as the ones doing the strong-arming, which Ramaswamy called “a protection racket.”

He singled out BlackRock CEO Larry Fink as the leader of the pressure campaign, which he says is not in the interests of companies – or the pension fund members whose savings Fink and others invest.

The big asset companies like BlackRock, Vanguard and State Street Bank are shareholders of almost every Fortune 500 company and if they vote for a policy, CEOs who do not comply open themselves up to potential legal issues because it could look as if they are not acting in the best interest of shareholders, several anti-ESG analysts told The Post.

“It’s a protection racket,” Ramaswamy told The Post Wednesday. “If company executives don’t go along with it, they could see their compensation cut or their bonuses disappear and the chance of further investment from the big three funds could go away.”

When Ramaswamy was executive chairman of his “anti-woke” asset management firm, Strive, he wrote letters to the boards of Apple and Chevron recommending that they decline to adopt ESG agendas which involved racial equity and climate policies. He called the agendas a “farce” and said they would not benefit shareholders.

Each company appeared to agree with Ramaswamy’s advice, he said – but then walked their plans back and all ended up voting in favor of the ESG proposals under pressure from the activists who pushed them.

“The sequence of events about their boards agreeing but then reversing course was not in relation to my letters,” Ramaswamy, whose new book on the topic, “Capitalist Punishment: How Wall Street is Using Your Money to Create a Country You Didn’t Vote For,” comes out April 25, explained.

“It was in relation to the shareholder proposals put up by the nonprofit organizations. The boards initially opposed them, until BlackRock and State Street supported them and voted in favor of them, after which Apple and Chevron each shifted course.”

Disney too, first balked at getting involved in the Gov. Ron De Santis “Don’t Say Gay” controversy in Florida but then went ahead and got on board to fight it.

Even worse, say Ramaswamy and other who oppose ESG, the fund managers who can influence how a corporate board votes are only proxy shareholders. They are using money from the pension funds of average Americans to jam through policy that the actual pension-holders might not even agree with – and which opponents say have been shown to lose money.

Sometimes, Ramaswamy said, Fink and others have to kowtow themselves to the ultra-liberals who run pension funds in blue states like California and New York if they want to manage that money. CalPERS, the California Public Employees’ Retirement System has more than $467 billion in funds.

ESG stands for “Environmental, Social and Governance,” which has been billed in recent years as a way to screen investments based on corporate policies and to encourage companies to act

“responsibly.”

The CEI score, overseen by the Human Rights Campaign (HRC), is a key tool in determining if companies are adhering to the the “social” portion of ESG, which includes LGBTQ+ policies.

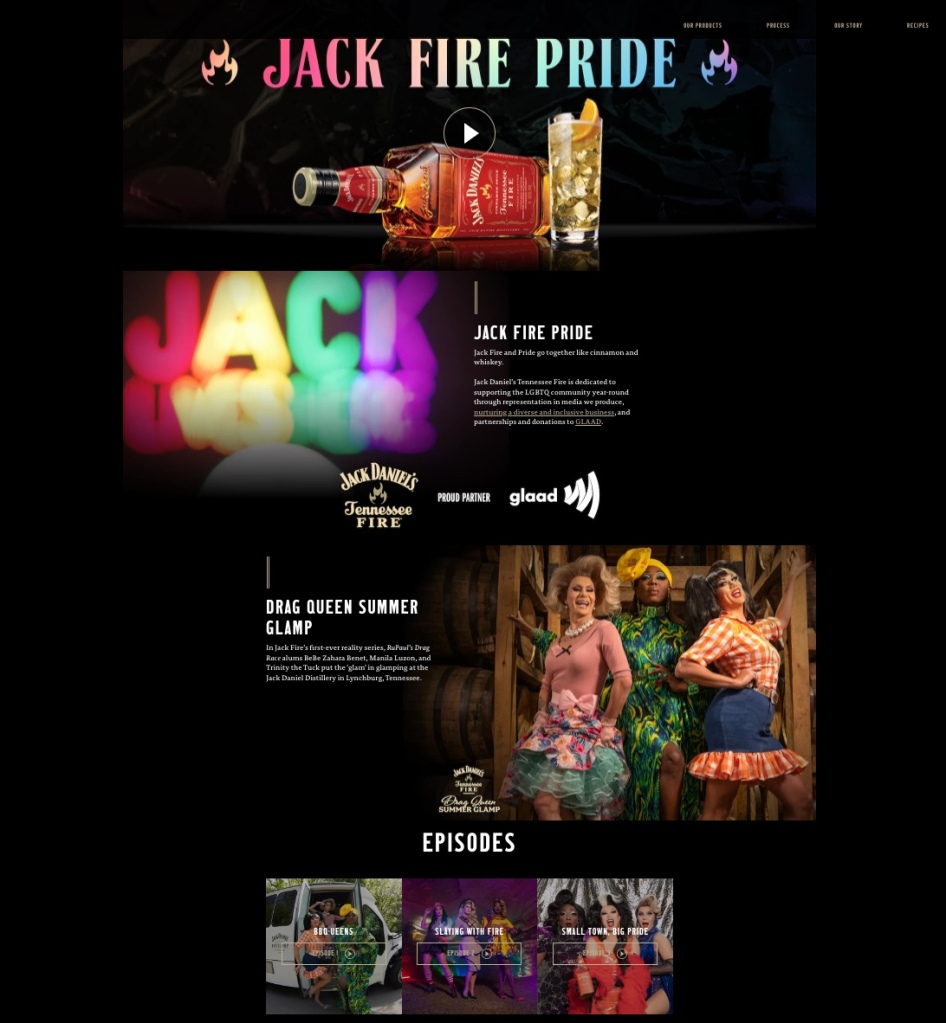

Companies like Anheuser Busch or Jack Daniel’s – whose “small town, big pride” 2021 ad campaign featuring drag queens from “Ru Paul’s Drag Race,” is receiving fresh backlash – brag about their high scores on their websites. Both have received scores of 100 in recent years.

But the pressure can be so intense from lobbying groups ranging from the HRC to Color of Change to the powerful Service Employees International Union, that companies ultimately can’t say no.

A company that rebels against playing ball with the CEI rating system will immediately feel the blowback, according to James Lindsay, a political podcaster who runs New Discourses.

“Sometimes it’s little things like if a company doesn’t get a 100 CEI score they won’t be allowed at a jobs fair at a university,” Lindsay told The Post. “Universities are suppressing companies that don’t have a 100 score by telling prospective graduates saying they’re bigoted places to work.”

Companies pay attention when they have to fill out their ESG paperwork, Lindsay said.

“They are chasing these scores because if you are not found to be compliant you could be de-listed from the portfolios of index funds and pension funds and that’s a whole chunk of money.”

In recent years, America’s top corporations have begun to give lucrative deals to what were once considered fringe celebrities because they have to — or risk failing an all-important social credit score that could make or break their businesses.

At stake are the points that make up their CEI score. HRC awards or subtracts points for how well companies adhere to what HRC calls its “rating criteria.”

Businesses that attain the maximum 100 total points earn the coveted title “Best Place To Work For LGBTQ Equality.” Fifteen of the top 20 Fortune-ranked companies received 100% ratings last year, according to HRC data.

The giant food services company, Sodexo, which was founded in France, is one of many top corporations that includes a page on its website proudly extolling its top CEI score. The company said that as of 2022, it had received a 100 score on the CEI.

“Our adoption of the pro-human approach ensures that we honor the distinct cultural and social identities of our team members,” Tony Tenicela, the company’s Vice President of Diversity, Equity, and Inclusion and PRIDE USA Executive Sponsor, stated.

“As an out leader and executive sponsor of our LGBTQ+ & Ally community, PRIDE, I am proud the HRC recognized Sodexo as one of the Best Places to Work. It demonstrates that our teams are safe, valued, and encouraged to bring their authentic selves to work

.”

Read the full article Here