Elon Musk vs. Twitter: all the news about one of the biggest, messiest tech deals ever

On Thursday, April 14th, Elon Musk announced an offer to buy Twitter for $54.20 a share. On April 25th, Twitter accepted the deal. By July 8th, Musk wanted out. Then Twitter sued Musk. And now we’re headed for Chancery Court in Delaware for a five-day trial in October that will determine who owns Twitter — and what happens after.

This is a huge story with a lot of fast-moving parts to it. It’s also a story that will likely stretch out over the next few months, maybe even longer. So we thought we’d put together a guide for you, our readers, that can be updated as things continue to unfold. Because, like Elon, we ❤️ you.

So strap in. It’s going to be a bumpy ride.

The latest news:

Peter “Mudge” Zatko was fired in early 2022 from his position as Twitter’s head of security. In July, he filed a whistleblower report saying Twitter has hidden negligent security practices, misled federal regulators about its safety, and failed to properly estimate the number of bots on its platform. Zatko is a long-tenured and well-respected voice in the hacker and security community, and his allegations are sure to have a huge impact in and out of Twitter. Congress, for one, has already said it is investigating Zatko’s claims.

Zatko’s disclosure says directly that Twitter lied to Musk about its spam and bot measurements, which could be fodder for Musk’s complaints about spambots, though Zatko’s support for those particular allegations feels fairly thin. Twitter denied all the accusations, calling them “a false narrative.”

The subpoenas ahead of the trial have become a who’s who of the tech industry, including Dorsey, Larry Ellison, Marc Andreessen, Tesla, Keith Rabois, and many others. Dorsey was a surprise but seems likely to have plenty of pertinent information, given both his tenure as Twitter CEO and the fact that Dorsey reportedly pushed hard to convince Musk to buy the company in the first place.

Illustration by Kristen Radtke / The Verge; Getty Images

The rest of the story so far:

The financing structure of Musk’s Twitter acquisition has shifted over time, but even after promising in April that “no further TSLA sales planned after today,” Musk sold another huge batch of his shares. “In the (hopefully unlikely) event that Twitter forces this deal to close *and* some equity partners don’t come through,” he tweeted soon after, “it is important to avoid an emergency sale of Tesla stock.”

Musk’s side wanted more time and for the trial to start in February 2023. Twitter wanted it to start as soon as possible. Kathaleen McCormick, the Delaware Chancellor who will oversee the trial, said the trial will start on October 17th and will last five days. Of course, that assumes the two sides don’t settle, and that remains anyone’s guess.

Twitter appears to be already feeling the Musk Effect: when it reported earnings in July, the company said its revenue fell for a variety of macroeconomic reasons but also because of what it described as “uncertainty related to the pending acquisition of Twitter by an affiliate of Elon Musk.” One thing Twitter won’t give Musk credit for? Its user growth. The service reported reaching more than 237 million daily users, up from 229 million last quarter. That, of course, was due to “ongoing product improvements.”

We wouldn’t normally tell you it’s worth reading a 162-page legal filing that gets deep into the weeds of bot measurement procedures. But this case has been filled with abnormally spicy legal fighting, much of which was clearly written to be read by a wide audience. It’s a good yarn.

Almost as soon as Musk made clear his intentions to get out of buying Twitter, Twitter filed a lawsuit that said, in effect: you agreed to pay $44 billion for Twitter, and we intend to get all $44 billion for our shareholders. Twitter filed its suit in the Delaware Court of Chancery, which immediately became the most exciting judicial system nobody had ever heard of. It paints a picture of Musk going out of his way to make an unexpected and unusually generous offer to Twitter, only to almost immediately turn around and start toying with the company and the idea of abandoning their agreement.

Twitter has filed a lawsuit in the Delaware Court of Chancery to hold Elon Musk accountable to his contractual obligations.

— Bret Taylor (@btaylor) July 12, 2022

It looked like it was going to happen, and then it did: only weeks after announcing his intention to buy Twitter, Musk tried to get out of it. Musk’s team claimed he was terminating the deal because Twitter was in “material breach” of their agreement and had made “false and misleading” statements during negotiations. In particular, Musk was concerned about the prevalence of fake or spam accounts on Twitter and what he saw as Twitter’s reluctance to prove its own research on the subject.

Musk joined a virtual town hall with Twitter employees and attempted to answer their questions about the future of the company and platform. He offered vague answers about wanting to emulate WeChat and learn from TikTok and letting people work from home more often while saying Twitter would attract 1 billion users. Meanwhile, he hinted that significant layoffs could be in the company’s future.

After a number of cagey tweets and “just asking questions” sorts of moves, Musk’s legal team made its first official threat to back out of the acquisition. In a legal filing, they claimed that Twitter failed to provide Musk with information on the service’s spam bot problem and that he’s entitled to receive that information under the deal agreement. Twitter, they wrote, was actively preventing him from getting the information he needed.

“My offer was based on Twitter’s SEC filings being accurate,” Musk tweeted, referencing Twitter’s oft-cited number that less than 5 percent of the accounts on the platform were fake or spam. “Yesterday, Twitter’s CEO publicly refused to show proof of <5%. This deal cannot move forward until he does.” Musk’s frustration appeared to be totally beside the point and the sort of thing he should have raised before signing a binding agreement to buy the company. But it was clear that if Musk decided he did want out, this would be his way.

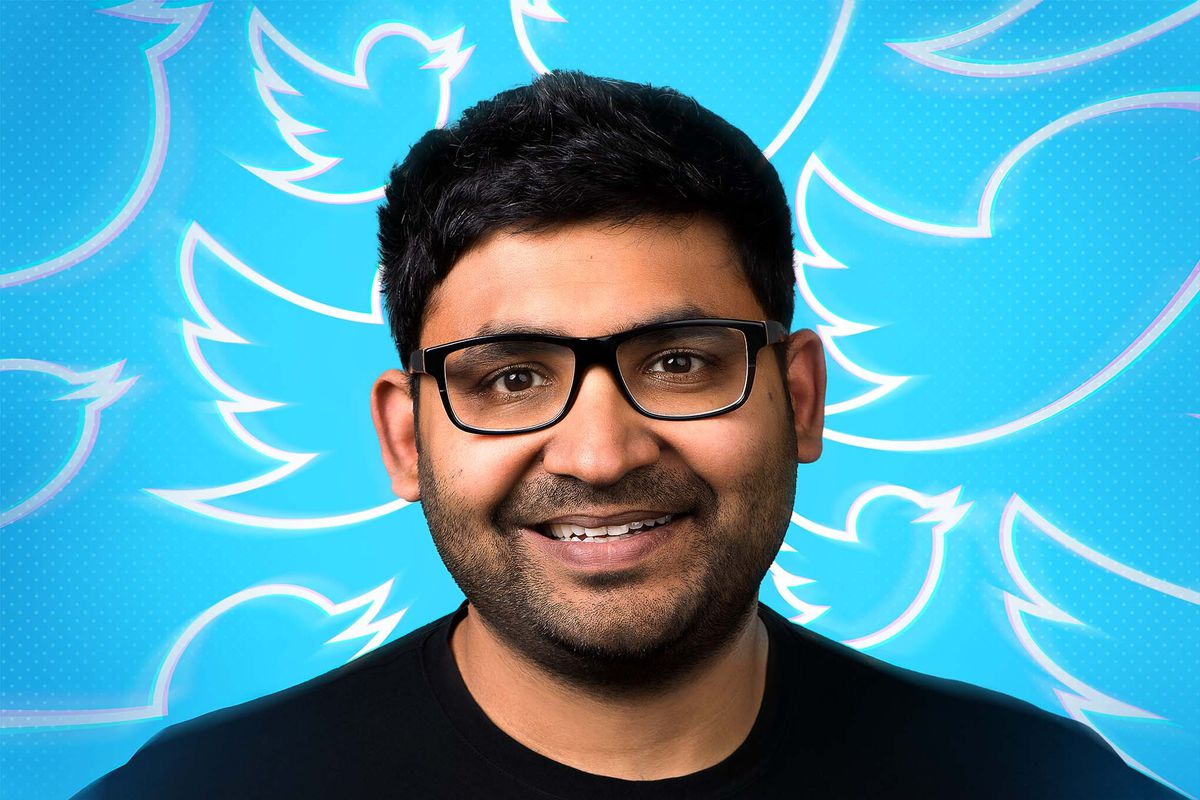

The turmoil inside Twitter wasn’t just coming from Musk and his legal team. Parag Agrawal, the still-new CEO of the company, fired some of his top executives, including consumer product leader Kayvon Beykpour and Bruce Falck, the general manager of revenue and head of product for its business side. “The priorities and decisions we make now will not only bolster how we navigate through this time,” Agrawal said in a memo to Twitter’s staff, “but also for the longer-term success of Twitter which I care about deeply.”

One other big Twitter-under-Musk question is what he’ll do about the platform’s permanent ban on Donald Trump. Musk said during a Financial Times conference that he’d undo it. “I guess the answer is I would reverse the permaban,” he said, “obviously I don’t own Twitter yet, so it’s not a thing that will definitely happen because what if I don’t own Twitter?”

Could Twitter Blue be the future of Twitter? Musk thinks so. He believes he can turn Twitter subscriptions into a $10 billion business by 2028, which would be double the entire company’s current revenue. Of course, that also includes huge user growth: Musk estimated Twitter could have 600 million users in 2025 and 931 million in 2028. That’s a big jump from the company’s current crop of 217 million users.

On April 25th, Twitter’s board of directors accepted Musk’s offer of $54.20 per share, or $44 billion, for total control of the company. It was the same price he named in his initial offer on April 14th. Upon completion of the transaction, Twitter will become a private company. Musk began working to line up financing for the deal and sold 9.6 million of his Tesla shares to free up about $8.4 billion.

Hours after announcing his bid to buy Twitter, Musk was on stage in Vancouver for a well-timed interview with TED Talk founder Chris Anderson. During the conversation, Musk spoke about his “obsession with the truth” and echoed comments he made in his SEC filing about wanting to protect free speech and democracy.

But as Adi Robertson pointed out, his understanding of free speech appears to be nebulous at best. After examining Musk’s comments, as well as previous efforts by Twitter’s leadership to contend with speech laws around the world, she concluded that Musk may be in for a rude awakening if he succeeds in buying the social media platform.

Twitter’s first all-hands meeting after Musk’s bid went public was a weird one. After serenading employees with Backstreet Boys and Aretha Franklin, the company said it would continue to evaluate the offer.

Employees told The Verge’s Alex Heath they were frustrated by the lack of a more detailed response. They’re concerned about the future of the social media platform, as well as the possibility of layoffs.

Illustration by Kristen Radtke / The Verge; Getty Images

Musk is a very rich guy. So, naturally, he would say that he isn’t interested in buying Twitter to make money. He views Twitter as the “de facto town square” and wants to open source the social media company’s algorithm. He tried to frame the whole takeover bid as some sort of crusade to protect free speech.

But even a free speech maximalist like Musk needs to convince shareholders that his buyout offer is in their financial self-interest. Otherwise, what are we really doing here?

Anyone who’s been in the market to buy a house knows about “best and final” offers. In his opening salvo, Musk claimed his bid to buy Twitter was exactly that. He was offering Twitter’s shareholders a pretty fair premium: $43 billion for a company with a $37 billion market cap.

Musk said that Twitter must go private in order to undergo the changes that need to be made. These included an edit feature, an open-source algorithm, less moderation, and a higher bar for removing offending tweets.

Photo by SUZANNE CORDEIRO/AFP via Getty Images

After news broke that Musk had acquired 9.1 percent of the company’s shares, many people briefly entertained the notion that Musk might try to buy the whole company, only to eventually conclude he had already gotten everything he wanted out of Twitter.

Casey was right in positing that Twitter’s poison pill provisions may not be enough to stop Musk. But he also assumed that Musk would just continue to troll the company through his tweets.

After declining a seat on Twitter’s board, Musk updated his filing with the Securities and Exchange Commission to indicate that he would not be a passive player in the company’s affairs. Gone was the language that he would restrict his holdings to just 14.0 percent of the company. In retrospect, this was the first clue that he may attempt something more impactful than just buying some stock of serving as a board member.

A thousand years ago, on April 4th, 2022, Elon Musk announced that he had purchased 9.1 percent of Twitter. The news that the world’s richest man was now (briefly) the largest shareholder in his preferred social media platform sent the stock price soaring and many a keyboard a-typing.

Musk immediately set about soliciting suggestions about ways to improve Twitter by — what else — tweeting a poll. The company responded by offering him a board seat, a move that would have restricted him to owning just 15 percent of the company. At first, he said yes. Then he changed his mind and said no. Meanwhile, our resident Twitter and Musk experts, Casey Newton and Liz Lopatto, respectively, dug deeper into why Musk was flirting with Twitter and what the likely outcomes would be.

Read the full article Here