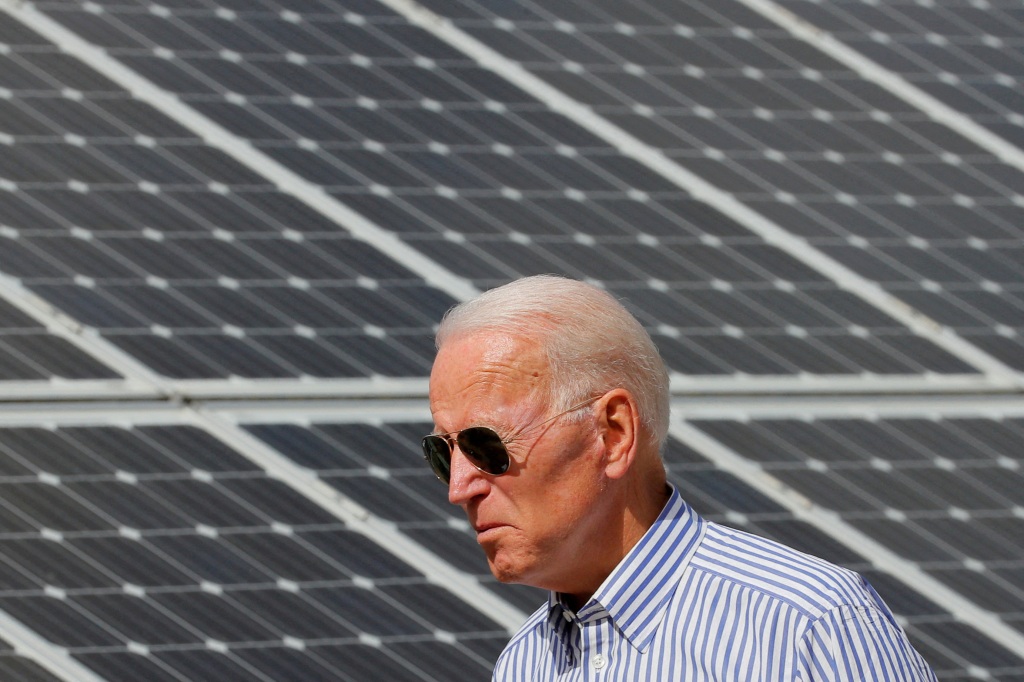

Green tax credits in Biden’s Inflation Reduction Act could cost US $1.2 trillion

That’s a lot of green.

Environmentally-focused tax credits in President Biden’s Inflation Reduction Act are poised to cost taxpayers as much as $1.2 trillion over the next decade, according to experts and recent cost analyses.

Producers are apparently cashing in on the sweeping climate and energy bill, which includes generous subsidies for manufacturing electric vehicles, batteries, and wind and solar energy initiatives.

In September of last year, one month after the law passed Congress, the nonpartisan Congressional Budget Office estimated the various energy subsidies coupled with new taxes on corporations and high earners would yield $738 billion in total revenue — while its climate and energy provisions would cost “just” $391 billion.

But recent analyses have pegged the cost of investing in renewable energy as far higher.

In March, Goldman Sachs reported the legislation will eventually cost three times the initial estimate: $1.2 trillion.

Meanwhile, a draft analysis from the Brookings Institution argued expenditures will hit $1.2 trillion by 2040 and $780 billion in the next decade.

Those increases would end up hiking deficits by $216 billion between 2022 and 2031, according to a January estimate from the White House’s own Office of Management and Budget.

“It’s the electric vehicles that overwhelmingly drive the shift from surpluses to deficits with this legislation,” Brian Riedl, a senior fellow at the Manhattan Institute, told The Post.

“The main change is that the electric vehicle incentives that were originally scored at $14 billion are now estimated by Goldman Sachs and Brookings to cost $390 billion,” he said. “So that turned a $230 deficit-reducer into a more than $200 billion deficit-increaser — according to the White House’s own budget office.”

According to E.J. Antoni, a research fellow at the Heritage Foundation, the CBO analysis also failed to anticipate how the law’s green subsidies would create incentives for producers.

Those incentives have spurred some companies to invest $150 billion collectively in clean energy production, according to the New York Times.

Research from George Mason University’s Mercatus Center also added up battery manufacturing tax breaks and found the costs could surge to nearly $200 billion, compared with the original CBO estimate of around $30 billion.

“It wouldn’t be the first time CBO was wildly wrong,” snarked one source close to the US Chamber of Commerce Thursday.

The revised forecasts have prompted Sen. Joe Manchin (D-W.Va.), who helped negotiate the bill, to accuse the Biden administration in March of improperly implementing the law, and later saying the president and Democrats “broke their word to the American public.”

“Let me be very clear,” he said in an April statement. “If the Administration does not honor what they said they would do, and continue to liberalize what we are supposed to invest in over the next ten years, I will do everything in my power to prevent that from happening. And if they don’t change, then I would vote to repeal my own bill.”

The error has given ammunition to Manchin’s 2024 challenger, West Virginia Gov. Jim Justice, who has mocked the Democrat’s vote to pass the Inflation Reduction Act as “a real, real screw-up.”

It has also heightened tense negotiations between the Biden White House and House Republicans, who passed a debt limit bill last week that would repeal almost all of the green tax credits from Manchin’s legislation.

Read the full article Here