Here’s why Americans think now is the time to buy a home

Despite the crush of inflation, rising mortgage rates to battle and the ongoing woes of rising rent, a new study shows that, hey, maybe there’s some reason for optimism?

Some six in 10 Americans, or 56%, believe that “right now” is the time to buy a house, according to the study, conducted by OnePoll on behalf of the fintech mortgage lender Lower. The survey compiled responses from 1,000 homeowners and 1,000 renters, finding that 55% of respondents claim ongoing record-high inflation has made them want to buy a home even more.

Specifically, 47% of that group said they aim to get one in the next year. The bulk of that individual sample, 74%, add that it would be their first time buying a house. Just 26% are existing homeowners who want to get something else.

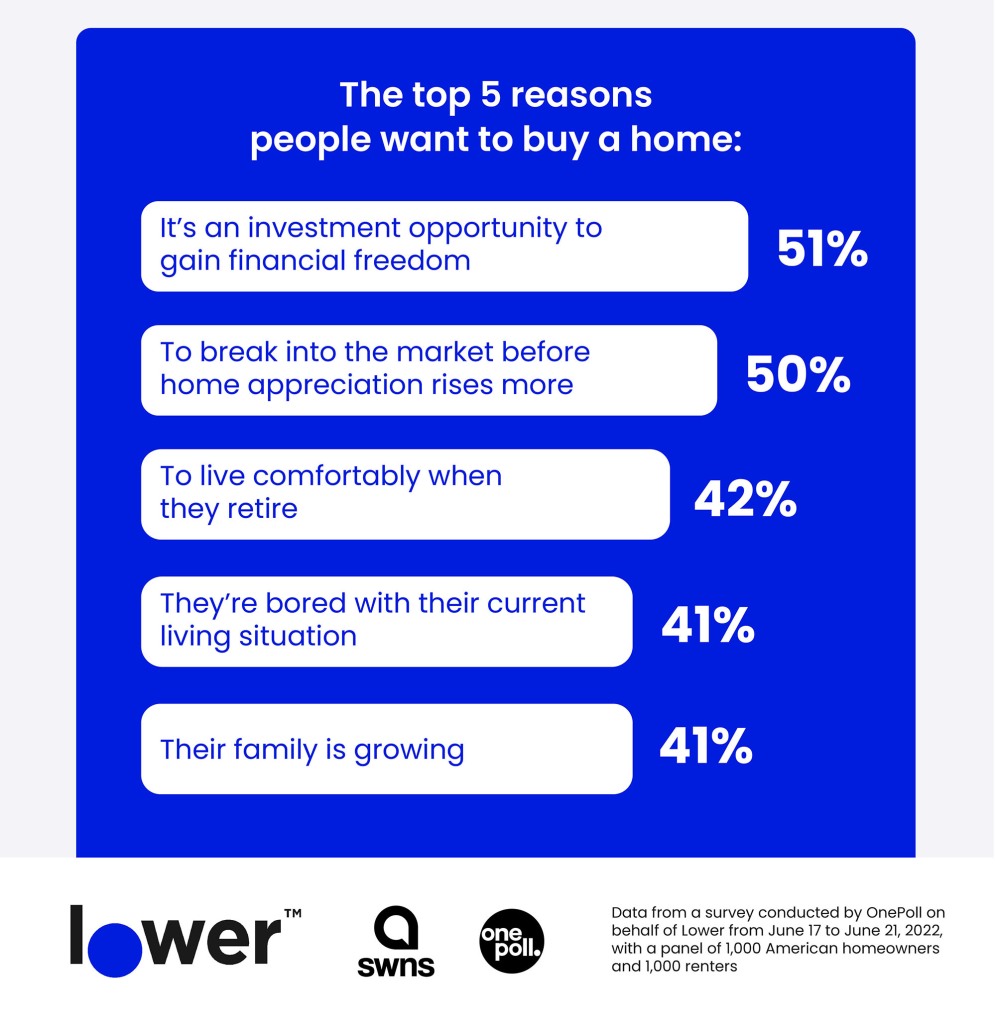

Just more than half of the participants — 51% — said they see homeownership as an investment opportunity toward financial freedom, while 50% said they want to get their foot in the door of homeownership before appreciation rises more. Others with their eyes on their golden years — 42% to be exact — said they want to live comfortably in retirement. (Of the total pool, 41% admitted to feeling bored in their current residences, and 41% aim to get a home for their growing family.)

“Homeowners have gained tens of thousands in equity over the past few years. This is money renters have left on the table,” Lower co-founder and CEO Dan Snyder said in the report. “A lot of people are waiting until prices cool off, but the reality is, they’ll just slow down from their record-breaking pace. Now is the time to buy before appreciation continues to climb.”

Of the study’s pool, 30% felt optimistic that the housing market will cool off in the next year — while 43% saw the “very” concerning status quo continuing, while 25% believed things will take a turn for the worst.

And though headlines of the housing market cooling off are making their way through the media, 45% of the poll’s participants said the boom — and the high demand that came with it — is actually getting even hotter. (Just 10%, meanwhile, thought the boom has slowed down.)

For the 1,000 renters, 56% of them said they want to move but can’t afford to. Among them, 27% pay $2,001 to $3,000 per month, 20% pay between $1,001 and $2,000 — while 16% owe $3,001 to $4,000 per month. Still, 57% of those 1,000 polled hoped to own their own homes one day. Their reasoning included financial stability — 40% — and the chance to gain financial freedom, for 35%.

“It may seem daunting, but it doesn’t have to be,” Snyder added. “Find a real estate agent and a lender who value the customer experience by creating a certain, simple process. They’ll help you along the way and your biggest worry will be finding the perfect home.”

Read the full article Here