IRS whistleblower testimony on Hunter Biden’s alleged tax fraud cover-up to be released

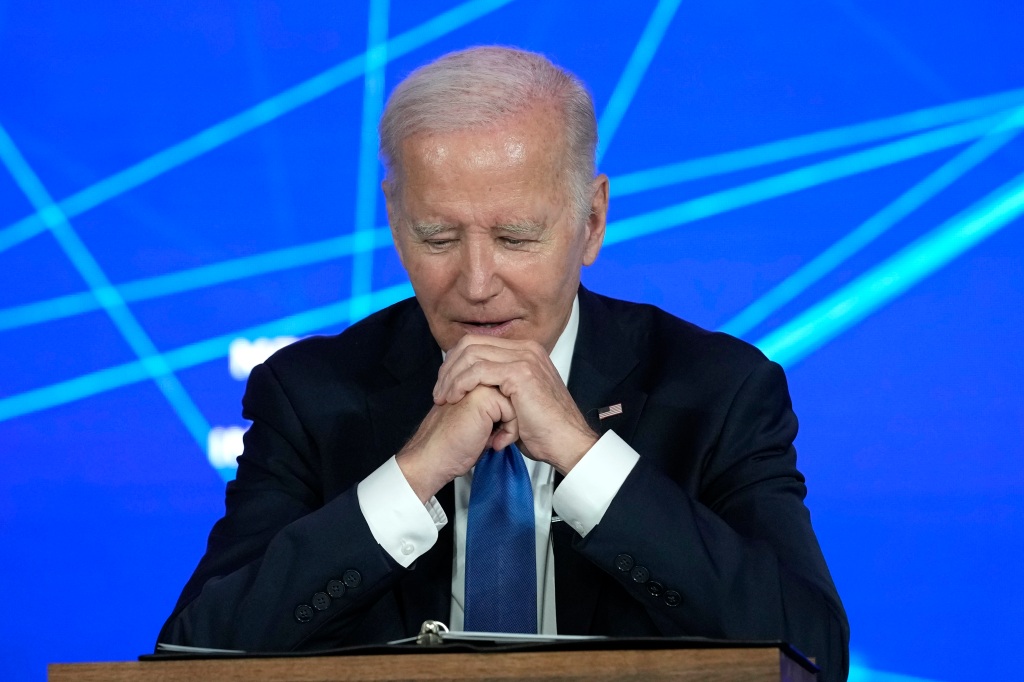

WASHINGTON — A House committee is expected to decide Thursday morning whether to release transcripts of testimony from two IRS whistleblowers who accused the Justice Department of a cover-up in the Hunter Biden tax fraud investigation.

Delaware US Attorney David Weiss announced Tuesday that the first son, 53, had agreed to cop to two tax-crime misdemeanors plus a felony gun charge that can be expunged after two years.

Hunter Biden is expected to receive probation, despite prison sentences in similar cases.

The House Ways and Means Committee will meet at 8 a.m. Thursday to discuss closed-door depositions by the whistleblowers amid outrage from Republicans and lawyers whose clients were treated more harshly for similar conduct.

“If the federal government is not treating all taxpayers equally, Congress has a duty to hold agencies accountable by providing transparency and bringing new facts to light,” the committee’s Republican majority said in a statement.

“That is why during Thursday’s session we will follow where the facts lead and will release the appropriate details afterward. The balance of justice must not be skewed in favor of the wealthy and the politically connected.”

IRS supervisory agent Gary Shapley spent about six hours describing his allegations to committee staff on May 26.

Shapley supervised the Biden scion’s case for more than three years and was backed up by a subordinate who had served as a primary case agent on the probe since it opened in 2018.

The second whistleblower, who has not been publicly identified, sat for a deposition by the committee days after his supervisor’s better-publicized appearance.

Shapley has worked at the IRS for 14 years and his deputy has worked there for 13 years.

In an initial April 19 letter to congressional leaders, Shapley’s attorney Mark Lytle wrote that his client could detail “preferential treatment” in the case, “politics improperly infecting decisions and protocols,” “clear conflicts of interest in the ultimate disposition of the case” and alleged false testimony to Congress by Attorney General Merrick Garland about Weiss’ ability to independently bring charges.

“It really doesn’t come down to his credibility, whether you believe him or not — because the things he’s been through are very well documented in emails, and other communications with the Department of Justice,” Lytle said at the time.

Exactly one week after Shapley first contacted Congress, Hunter Biden’s legal team met with Justice Department leaders in Washington in what experts interpreted as a sign that a charging decision was close. The IRS removed the entire investigative team from the case on May 15, allegedly on Justice Department orders.

The whistleblower allegations of a coverup were vaguely described by Shapley in media interviews and by his subordinate in a protest email to his superiors that was made public after the tax agents were purged from the investigation.

Tax privacy laws prevented the IRS agents from going into details, though their disclosures to members of Congress were legally protected and the Constitution gives lawmakers the power to release whatever information they want.

Garland, whose role in the final plea deal is not well understood, has broadly denied misleading Congress about Weiss’ independence.

Shapley said in a “CBS Evening News” interview last month that “I don’t want to do any of this,” but that he felt compelled to step forward following a contentious meeting in October involving Justice Department tax lawyers and an unnamed US attorney.

Since he was assigned to the case, “I immediately saw deviations from the normal process. It was way outside the norm of what I’ve experienced in the past,” Shapley told CBS.

The case agent, meanwhile, wrote to his bosses in an email last month that IRS investigators had raised alarms “for some time” that the Justice Department and Delaware US attorney’s office were “acting inappropriately.”

He added, “my husband and I (identifying me as the case agent) were publicly outed and ridiculed on social media due to our sexual orientation, and to ultimately be removed [from the investigation] for always trying to do the right thing, is unacceptable in my opinion.”

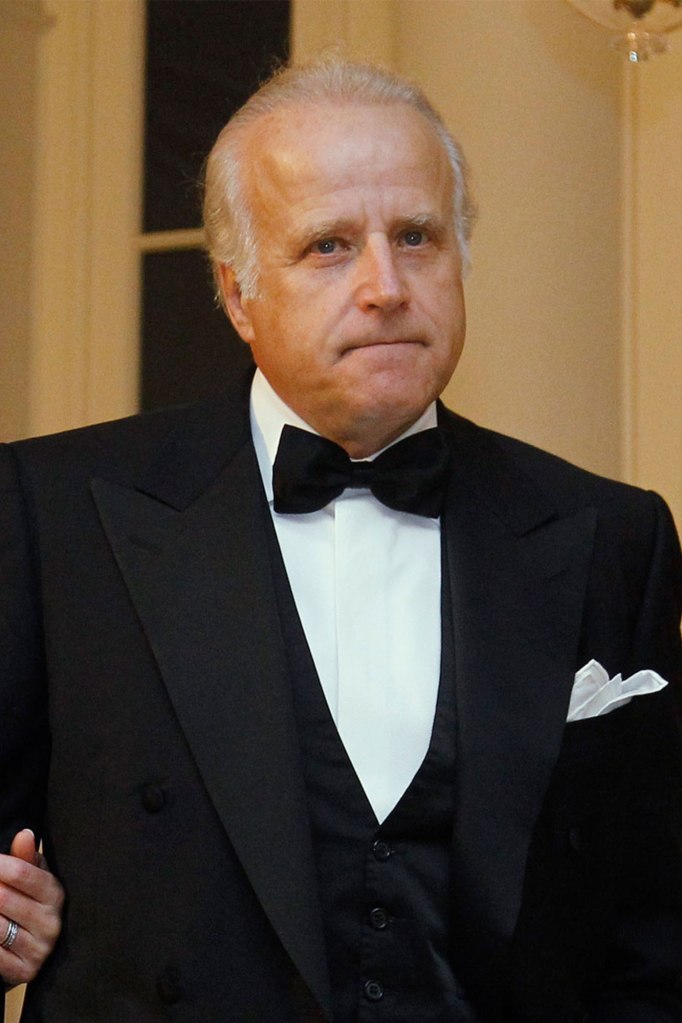

Hunter Biden and first brother James Biden reaped millions of dollars from overseas ventures that Republicans call influence-peddling during and immediately after his father’s vice presidency.

Wealthy figures in China, Kazakhstan, Mexico, Romania, Russia and Ukraine are counted among Hunter’s past clients and associates — with Joe Biden interacting with many of the key business figures.

Hunter wrote in emails retrieved from his former laptop that he had to give “half” of his income to Joe Biden and records show that the elder Biden even appeared to be penciled in for a 10% cut of proceeds from a Chinese government-linked partnership under negotiation in 2017.

The House Oversight Committee is investigating an FBI informant’s report that an executive from Ukrainian gas company Burisma paid $10 million in bribes to Joe and Hunter Biden.

President Biden denies the allegation.

Hunter earned up to $1 million to serve on the company’s board beginning in April 2014 as his father assumed control of the Obama administration’s Ukraine portfolio.

Weiss, who announced the Hunter Biden plea deal, is a Trump administration holdover recommended to his post by the state’s Democratic senators, who are close Biden allies.

Hunter Biden’s attorney Chris Clark said Tuesday that it’s his understanding that the investigation of his client is “resolved,” though Weiss said in a statement that his investigation is “ongoing.”

House Republicans fear Weiss’ use of the term is designed to justify non-transparency in response to document requests.

Hunter reportedly borrowed about $2 million last year from Hollywood lawyer Kevin Morris to pay his back taxes, though doing so didn’t legally absolve him of the original non-payment.

Initial court filings in his plea deal didn’t describe how much in taxes he evaded — only specifying the amount was greater than $100,000 in both 2017 and 2018.

The first son was not charged with money laundering or with working as an unregistered lobbyist under the Foreign Agents Registration Act, despite evidence that strongly suggests he did so.

Read the full article Here