Manchin rips Biden electric car tax credit cuts: ‘Stop this’

Sen. Joe Manchin (D-WV) ripped the Biden administration again on Friday after the Treasury Department proposed new rules that would reduce federal tax credits for electric vehicles (EVs) — calling them “horrific” and claiming they would only benefit China and harm US manufacturers.

“Yet again – the guidance released by the Department of the Treasury completely ignores the intent of the Inflation Reduction Act,” Manchin said in a statement.

“American tax dollars should not be used to support manufacturing jobs overseas,” he added. “It is a pathetic excuse to spend more taxpayer dollars as quickly as possible and further cedes control to the Chinese Communist Party in the process.”

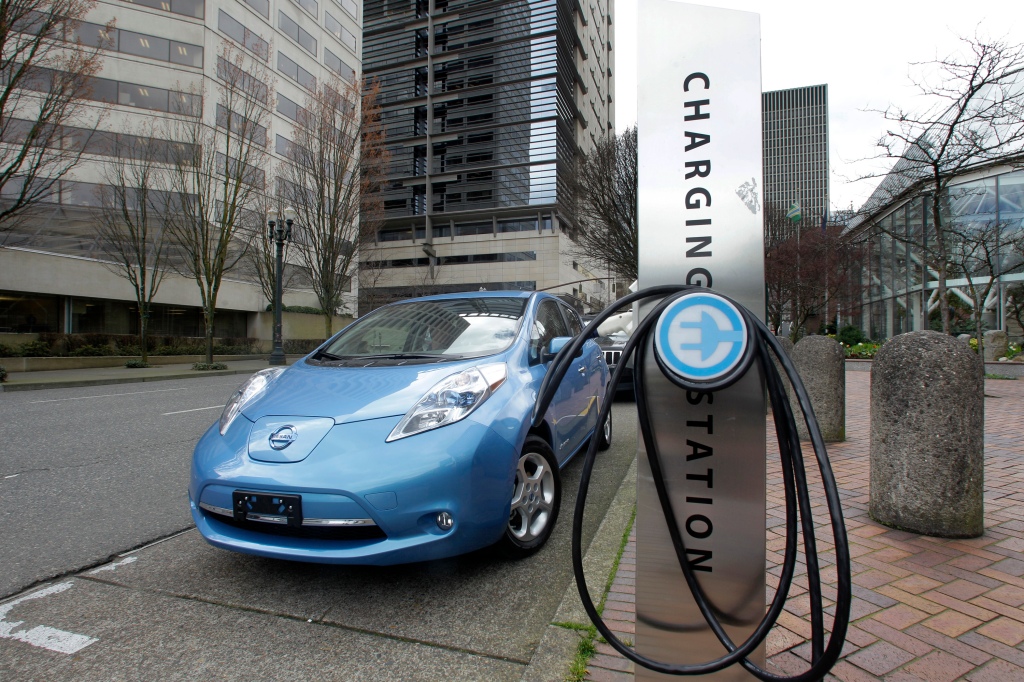

The rules, which are set to take effect April 18, would disqualify many new EVs this year from the full $7,500 tax credit under the law Manchin helped negotiate last year — with many only getting half that amount.

Eligibility for the full credit hinges on ramping up the percentage of electric car battery parts and minerals that come from countries that have free trade or mineral agreements with the US, according to the Treasury.

However, the rules also do not prevent manufacturers from sourcing battery parts from China or Russia until 2024, while minerals from those countries are not prohibited until 2025.

Most of the lithium used in EV batteries currently comes from China.

“It is horrific,” Manchin said, “that the Administration continues to ignore the purpose of the law which is to bring manufacturing back to America and ensure we have reliable and secure supply chains.”

“The guidance includes a 60-day comment period and I ask for every American to comment. My comment is simple: stop this now – just follow the law.”

President Biden announced in August 2021 it was a goal of his administration to make 50% of new cars “zero emission” by 2030.

The new Treasury rules mandate that EVs have at least 40% of their battery minerals come from the US or nations with which it has trade deals. That percentage rises by 10% each year until it hits 80% by 2026.

Those nations include Australia, Bahrain, Canada, Chile, Colombia, Costa Rica, the Dominican Republic, El Salvador, Guatemala, Honduras, Israel, Jordan, Korea, Mexico, Morocco, Nicaragua, Oman, Panama, Peru, Singapore and Japan.

The rules also mandate that at least 50% of the value of battery parts have to be made and assembled in North America. That percentage must rise to 60% in 2024 and 2025, and further rise 10% each year until it hits 100% in 2028.

Automakers will receive $3,750 in tax credits if they certify having met each of the mineral and battery requirements.

Most EVs are too expensive for the typical American household, costing an average of $58,000 at Kelley Blue Book value.

The Inflation Reduction Act caps the price of new electric cars at $55,000 and new electric pickups, vans and SUVs at $80,000. The law also prohibits higher-income buyers from receiving the tax credits, excluding those with an adjusted gross annual income above $150,000 if single, $300,000 if married and $225,000 if head of a household.

The Internal Revenue Service currently lists dozens of EVs eligible for the credits — a number that will shrink if the rules are approved.

Treasury Secretary Janet Yellen said Friday the new rules will help consumers save money on EVs “and hundreds of dollars per year on gas, while creating American manufacturing jobs and strengthening our energy and national security.”

Alliance for Automotive Innovation CEO John Bozzella told the Associated Press that only a few of the 91 EV models for sale in the US likely will get the full credit, but some will qualify for half.

“We now know the EV tax credit playing field for the next year or so. March 2023 was as good as it gets,” he said.

General Motors says its EVs will only be eligible for the $3,750 half credit once the rules take effect, as the company has yet to build up its US supply chain.

Manchin took to the opinion pages of The Wall Street Journal on Wednesday to also hit the Biden administration for stifling US fossil fuel production in its execution of the Inflation Reduction Act.

“[I]nstead of implementing the law as intended, unelected ideologues, bureaucrats and appointees seem determined to violate and subvert the law to advance a partisan agenda that ignores both energy and fiscal security,” he wrote.

“Specifically, they are ignoring the law’s intent to support and expand fossil energy and are redefining ‘domestic energy’ to increase clean-energy spending to potentially deficit-breaking levels. The administration is attempting at every turn to implement the bill it wanted, not the bill Congress actually passed,” Manchin said.

With Post wires

Read the full article Here