NYC toy store Camp begs for cash after Silicon Valley Bank crash

A New York City-based toy company in hot water after getting caught up in the sudden collapse of Silicon Valley Bank is now begging customers for help keeping it afloat.

The venture capital-backed retailer Camp fired off an email Friday to customers, saying it was slashing prices and plans to use sales revenue to continue operating, after much of its cash was tied up in the second-biggest bank casualty in U.S. history.

“Unfortunately, we had most of our company’s cash assets at a bank which just collapsed. I’m sure you’ve heard the news,” co-founder Ben Kaufman said in an email to customers, according to CNN.

Kaufman asked customers to use the code “BANKRUN” to save 40% off all merchandise — a likely nod to the run on the bank that may have helped bring down the Silicon Valley lender. The company also said customers could pay full price, adding that would be appreciated.

Kaufman said Camp is “hopeful that this will be resolved soon.”

CNN has not confirmed if Camp had funds with Silicon Valley Bank when the bank collapsed.

The sudden collapse of the niche California-based tech- and startup-focused lender has fueled market chaos and sparked fears of a wider contagion that some experts worry could upend the US banking sector.

It was abruptly shut down on Friday by the California Department of Financial Protection and Innovation, which placed its remaining assets under the Federal Deposit Insurance Corp.’s control.

SVB’s finances went south at warp speed after it disclosed a $1.8 billion loss on its bondholdings this week.

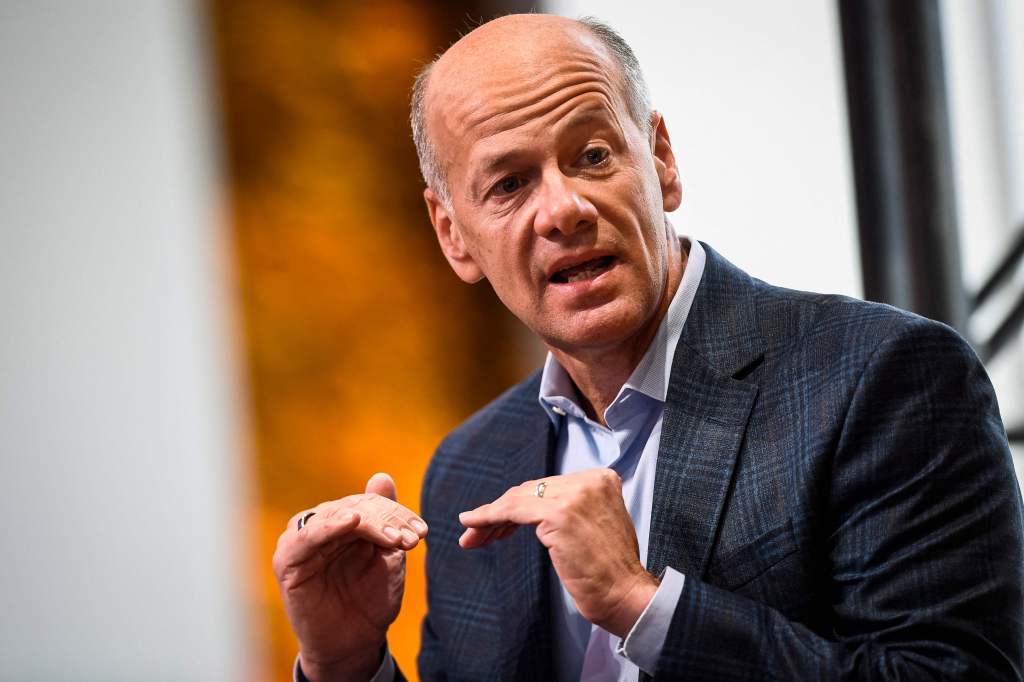

CEO Greg Becker had urged investors on a Thursday conference call to “stay calm” and not “panic” — but jittery clients were already scrambling to yank large balances in excess of the FDIC’s $250,000 insured cap.

On Friday, he sent a video message to employees acknowledging the “incredibly difficult” 48 hours leading up to the collapse.

“It’s with an incredibly heavy heart that I’m here to deliver this message,” he said in a video. “I can’t imagine what was going through your head and wondering, you know, about your job, your future.”

He asked employees to “hang around, try to support each other, try to support our clients, work together” to get a better outcome for the company.

In 2015, Becker appeared before a Senate committee to successfully lobby for exemption from rules passed after the 2008 crash, the independent news outlet The Lever reported. The CEO argued his bank should not be subject to scrutiny — insisting that “enhanced prudential standards” should be lifted “given the low risk profile of our activities.”

In a related move, Becker was removed from his position as a member of the Federal Reserve Bank of San Francisco’s board of directors, a post he held since 2019.

With Post Wires

Read the full article Here