Gen Z tanks credit with buy-now-pay-later apps like Klarna

Last July, Armani Bryan spotted a $2,000 blue Marine Serre dress on posh digital retailer Farfetch that she just had to have — but couldn’t quite afford.

And so, the 20-year-old Miami native used payment-postponement app Klarna, figuring there’d be no harm in purchasing the frock in four installments through Klarna’s seductive “Pay in 4” option.

But for Bryan, Klarna’s updated, glossy take on layaway turned out to be too good to be true. Now saddled with debt and a dismal credit score, she joins the more than 717,000 millennials and Gen Zers commiserating on TikTok over their respective buy-now-pay-later, or BNPL, horror stories via the hashtag #KlarnaCredit.

“I thought paying for this dress in four [installments] would be easy for me, but it wasn’t,” Bryan told The Post.

The financial technology company, founded in Stockholm, Sweden, in 2005, offers its reported 150 million users the option to evenly divide the total price of an item into four payments, and pay off the balance over a six-week period with “no interest or fees if you pay on time,” per its website.

Once a customer agrees to the terms, the system allows the patron to make an initial deposit at check-out, and then it automatically collects the three following payments via the person’s on-file debit card every two weeks.

But the most enticing part of the deal is, unlike classic layaway programs, in which retailers retain possession of a commodity while the customer chips away at the cost over time, Klarna releases the product to its clients immediately after the initial payment is made — a perk that seems to beguile young consumers.

A March 2021 study by financial analysis research firm the Ascent found that nearly 56% of consumers made purchases through BNPL giants like Klarna, Afterpay, Affirm, Sezzle and Zip — all of which have different late fee, interest and debt-collection policies — between 2020 and 2021. And research published in June by eMarketer revealed that millennials and zoomers, like Bryan, make up almost 75% of payment-postponement service users.

But after purchasing her high-ticketed frock through Klarna — which is backed by a slew of trendy tastemakers like rappers Snoop Dogg, a minority shareholder, and A$AP Rocky — she found herself suffocating in debt to the service that promises users “financial breathing room.”

“They are relying on customers to fall behind on payments,” Bryan said. “That way, they’re able to collect late fees and report you to debt collectors.”

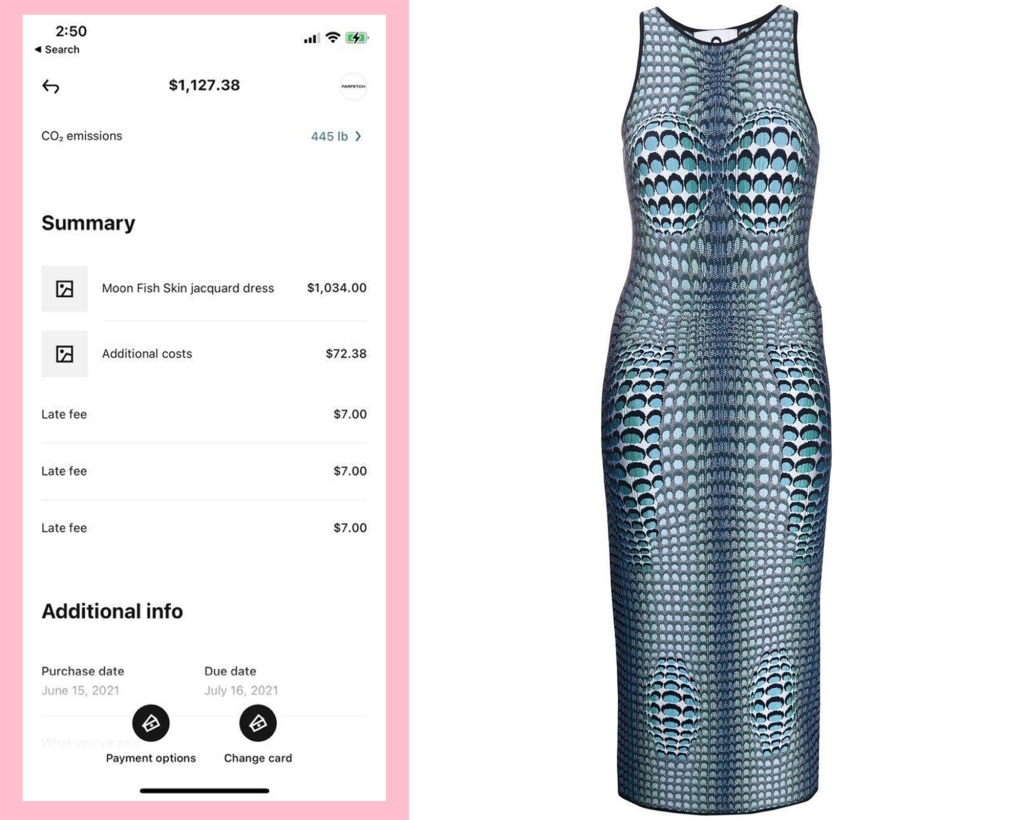

In the summer of 2021, Bryan “fell on hard [financial] times” and was unable to cover the balance of her loan. She still owes $1,034 for the dress, plus $93.38 in fees. She said she’s also regularly hounded by collection agencies pressing her to pay up.

She’s not the only one with a Klarna-related crisis.

For college student Amy Douglas, the BNPL app enabled her to impulse buy and created a “vicious cycle.”

In the summer of 2019, the 22-year-old part-time retail worker began treating herself to trendy duds at online shops like ASOS, and using Klarna to defer the payments. Her splurges felt reasonable — a $112 dress here, and $150 coat there — but they added up.

“[Klarna] almost made it seem like I was getting these things for free,” Douglas, who lives in Cumbria, UK, told The Post.

But when bills began rolling in, demanding over 40% of her monthly $630 income, she was forced to beg loved ones for loans.

“It was so embarrassing that I got myself into such large amounts of debt just because I couldn’t control what I was spending,” said Douglas, who hit up her boyfriend and her dad before paying off her full balance this past April. “I never missed a payment to Klarna, because I was terrified at the mere thought of a debt collector knocking at my door.”

A spokesperson for Klarna told The Post that the company does not “benefit from people being in long-term debt.” Instead, the rep claims that the company works to “ensure we only lend to those who can afford to repay.” Per its site, Klarna turns a profit by charging a retailer’s fee to its 400,000 merchant partners — like H&M, Nike and Peloton — on each transaction.

And, while the BNPL behemoth markets itself to customers as having “no impact on your credit,” its fine print does warn patrons that “missed payments and unpaid debts are sent to debt collection.” It also claims to extend support to users in financial straits. (Bryan alleges she reached out to the company regarding her financial woes, but received no assistance.)

Bryan has also gotten herself into trouble with Affirm, another deferred-payment app that appeals to young customers. Last summer, she racked up purchases using their “Pay in 4” option, which she claims then tanked her credit score after a few late payments. However, a rep for Affirm told The Post, “There is no credit reporting with our ‘Pay in 4’ option. We only report longer term monthly loans.”

TikTok financial educator Ben Markley told The Post that young consumers should be wary of all BNPL apps.

“They’re enabling you to spend money that you don’t have yet, which really just means you’re tying up your future paychecks,” said Markley of budgeting brand You Need a Budget.

Instead, he said millennials and zoomers would be wise to use another time-honored tactic: Save up for big purchases.

“Create a [biweekly] budget for yourself, and set aside what would be the same amount you’d pay in a four-installment payment program,” said Markley. “And after two months, you’d be able to purchase the item in full, without the stress of getting into debt.”

Read the full article Here