State AGs weigh legal challenge to Biden’s $500B student loan handout

GOP state attorneys general and conservative groups are weighing legal challenges against President Biden’s decision to cancel between $10,000-and-$20,000 in student debt for some Americans.

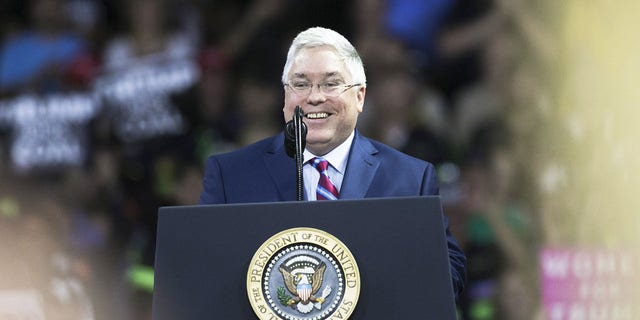

“We’re actively looking into legal options to halt the Biden Administration’s abuse of power and assault on working-class Americans,” Missouri Attorney General Eric Schmitt told Fox News Digital.

Conservative groups like the Job Creators Network, which is assessing legal and political options to oppose the handout, say the argument for Biden’s ability to act unilaterally in canceling student debt for millions of borrowers rests on shaky ground.

“This a bailout enacted by executive overreach akin to the administration’s illegal employer vaccine mandate and eviction moratorium that were struck down by the Supreme Court,” said Alfredo Ortiz, the group’s president. “Like those examples of Biden’s regulatory state, this action should also be challenged in court.”

WHITE HOUSE SILENT ON WHETHER TAX INCREASES ARE NECESSARY TO PAY FOR $300,000,000,000 STUDENT LOAN HANDOUT

The first step to a legal challenge is finding someone with standing to sue. That means lawyers will have to demonstrate the decision to cancel student debt does concrete harm to at least one party and how a court blocking the handout will remedy that harm.

At the moment, finding someone that has been harmed by the decision looks difficult.

The Supreme Court has already stated that taxpayers do not have standing to sue the government, and neither does Congress. Borrowers who already paid off their loans and therefore will not qualify for the handout are unlikely to have standing either since they are not directly injured by the White House’s action.

State governments similarly are viewed as not having standing since the student debt handout does not impose a burden on their finances or powers.

WHITE HOUSE OFFICIALS STAND TO BENEFIT FROM BIDEN STUDENT DEBT HANDOUT: WATCHDOG GROUP

Legal experts say that loan services might have the best standing for a lawsuit since they will be directly impacted the handout. Loan servicers could argue that Biden overreached by issuing a blanket handout, instead of tailoring the proposal to individuals with proven economic hardship.

Some federal courts, though, have refused in the past to allow government contractors to sue against regulations that hurt their profit margin.

West Virginia Attorney General Patrick Morrisey told Fox News Digital that once the standing issue is addressed, there was plenty of legal precedent for blocking the handout. Morrisey referenced his recent victory before the Supreme Court in West Virginia v. EPA, a ruling that significantly curbed the federal government’s power to regulate greenhouse gas emissions without congressional approval.

In coming to its 6-3 decision, the high court invoked a longstanding legal doctrine that says Congressional authorization is needed if federal agencies are taking major actions that have large economic and political significance.

“We’re looking at a wide variety of questions, but the Supreme Court’s decision in my case could be substantive to the argument against the White House’s action,” said Morrisey. “It’s also going to be important to determine how closely connected this decision is to any reported national emergency and whether Congress ever envisioned this would come to pass when passing the law cited as justification by Biden.”

The White House announced Wednesday plans to forgive $10,000 in student debt for borrowers making less than $125,000 annually. Pell Grant recipients will receive $20,000 in debt handouts provided their income is below the $125,000 threshold. Administration officials claim that no individual or household in the top 5% of earners will benefit from the decision.

The Committee for a Responsible Federal Budget estimates the handout could cost U.S. taxpayers roughly $500 billion or more over the next decade.

In justifying the move, Biden invoked the 2003 HEROES Act. Passed in the wake of the September 11th terrorist and at the height of the War on Terror, the law allows the Secretary of Education to waive or modify student financial aid programs in times of war or national emergency.

The law stipulates that the authority applies to active duty military personnel, individuals residing in an area impacted by a national emergency, and those who have suffered “economic hardship” as a direct result of war, military operation, or national emergency.

Biden’s Justice Department cites the “economic hardship” clause in arguing that the education secretary can cancel student loan debt en masse because of the lingering effects of the coronavirus pandemic.

The HEROES Act “grants the Secretary of Education authority to reduce or eliminate the obligation to repay the principal balance of federal student loan debt, including on a class-wide basis in response to the COVID-19 pandemic, provided all other requirements of the statute are satisfied,” wrote Assistant Attorney General Christopher Schroeder.

Critics note, however, that the Biden administration has previously argued in court that the coronavirus pandemic was over when seeking to rescind Title 42 — a Trump-era pandemic emergency order to expel illegal aliens at the border.

“The Biden administration argues COVID has ended at the southern border (Title 42) but is somehow still an emergency so … the taxpayer have to pay $300B+ for Biden’s student loan debt transfer,” said Chad Gilmartin, a spokesman for House Minority Leader Kevin McCarthy, on social media.

Read the full article Here