House Republicans propose higher taxes on university endowments to pay for Biden’s student loan relief

EXCLUSIVE: A group of House Republicans is introducing legislation to increase taxes on university endowments to ensure taxpayers do not have to foot the bill for President Biden’s more than $500 billion in student loan debt forgiveness.

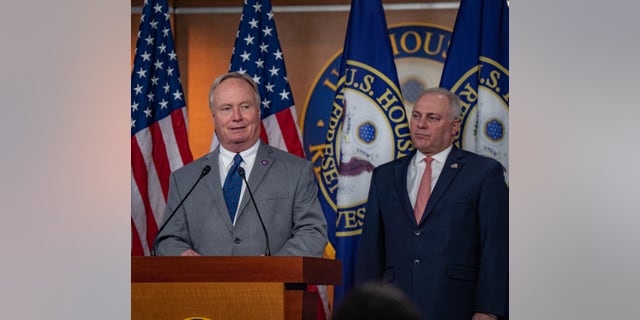

Rep. Dave Joyce, the chairman of the moderate 44-member Republican Governance Group, told Fox News Digital the legislation is designed to hold higher education institutions accountable for the skyrocketing cost of a college degree.

“America’s elite universities are the silent beneficiaries of President Biden’s misguided student debt bailout,” said Joyce, R-Ohio. “These institutions need to be held accountable for their role in our nation’s ballooning student debt.

Joyce is backing the bill with two other GOP colleagues, Reps. Byron Donalds of Florida and Mayra Flores of Texas. The trio argues it is unfair for taxpayers to be saddled with the cost of Biden’s program while little is being done to force America’s colleges and universities to lower costs for students.

PENNSYLVANIA MANUFACTURING WORKERS BLAST BIDEN’S STUDENT LOAN HANDOUT AS UNFAIR

“Transferring $600 billion in student debt from one group of Americans to another does nothing to make education more affordable,” said Joyce. “Instead, it incentivizes wealthy universities to continue driving up their tuition costs amid record-breaking inflation.”

The legislation would increase from 1.4% to 10% the tax that universities have to pay each year on profits generated from investments or interest stemming from their endowments. The tax was created as part of former President Donald Trump’s signature 2017 tax law.

WHITE HOUSE SUGGESTS BIDEN’S $500B STUDENT LOAN HANDOUT WILL BE PAID FOR WITH DEFICIT SPENDING

Joyce’s bill would expand the number of colleges and universities that would be subject to the tax. Currently, only higher education institutions with endowments valued at $500,000 per student are subject to the tax. The legislation would lower that threshold to $250,000 per student, forcing schools like Johns Hopkins University, Carnegie Mellon University, and Boston College to pay it.

The bill also penalizes colleges and universities that raise their net price of attendance to more than the rate of inflation for the previous three years by increasing the annual tax on endowments to 20%.

Supporters of the bill point to a recent study by the National Bureau of Economic Research showing that as university endowments increase there is no significant reduction in the list price of tuition and housing for students.

President Biden announced plans last month to forgive $10,000 in student debt for borrowers making less than $125,000 annually. Pell Grant recipients will receive $20,000 in debt forgiveness, provided their income is below the same threshold.

The Committee for a Responsible Budget puts the cost of the program at between $440 billion and $600 billion. White House officials claim, however, the proposal is fully paid for because the annual budget deficit is shrinking thanks to reduced spending in other areas.

“It is paid for and far more by the amount of deficit reduction that we’re already on track for this year,” said Bharat Ramamurti, deputy director of the National Economic Council. “We’re on track for $1.7 trillion in deficit reduction this year.”

Economists say the White House’s comments and unwillingness to outline offsets for the student debt handout, like tax increases or budget cuts, means the cost of the program will add to the annual budget deficit, which will land at about $1 trillion for the fiscal year that ends Sept. 30. They also say that just because spending in one area is falling doesn’t mean new spending is free.

“The analogy is a family going into debt for a $100,000 medical emergency, and the next year buying a $50,000 sports car and claiming that it’s ‘free’ because they are no longer spending $100,000 per year on the medical emergency,” said Brian Riedl, a senior fellow in economics at the center-right Manhattan Institute.

Experts argue that once added to the debt, future taxpayers will be forced to pick up the tab for the handout.

“If this ends up being added to the national debt, it’s just going to drive up the interest costs needed to not default on that figure,” said Riedl. “All of that is eventually going to drive up taxes because, at some point, you’ll have to figure out a way to pay that debt.”

Read the full article Here