Trump slams Biden student loan handout as ‘election enhancing money grab’: ‘Stop voting for Democrats!’

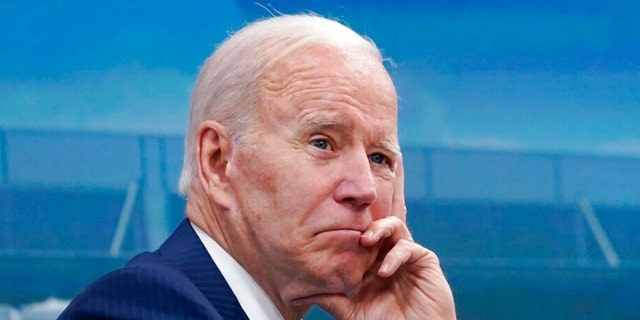

Former President Donald Trump slammed President Biden for orchestrating “another election enhancing money grab” with his move to cancel millions of dollars in student loan debt, warning that working-class Americans will foot the bill, while urging voters to “stop voting for Democrats.”

“Joe Biden and the Radical Left Democrats have just orchestrated another election enhancing money grab, this time to the tune of $300,000,000,000 — and just like I predicted, it’s coming right out of the pocket of the working-class Americans who are struggling the most!” Trump said Thursday in a statement. “Crippling inflation, unaffordable energy prices, and WAR — all things that should never have happened.”

“But if that wasn’t enough, now Americans are bailing out College Administrators who fleeced students, and those who opted for Degrees there was no way they could afford,” Trump continued. “America is a nation in decline, and the cliff into oblivion is within sight.”

He added: “Stop voting for Democrats! MAKE AMERICA GREAT AGAIN!”

BIDEN ANNOUNCES STUDENT LOAN HANDOUT AS NATIONAL DEBT SOARS

Biden announced Wednesday that he will deliver on a campaign “commitment” to cancel $10,000 of federal student loan debt for certain borrowers making less than $125,000 per year, and up to $20,000 for Pell Grant recipients, while extending the pause on federal student loan payments through the end of the year.

According to a Penn Wharton Budget Model, a one-time maximum debt forgiveness of $10,000 for borrowers who make less than $125,000 will cost around $300 billion for taxpayers. Some economists argue that will spur inflation. The $300 billion adds up to about the amount of deficit reduction included in the so-called Inflation Reduction Act passed earlier this month.

And according to an estimate from the Committee for a Responsible Federal Budget, the plan will cost U.S. taxpayers between $440 billion and $600 billion over the next 10 years.

The nation’s federal student debt now tops $1.6 trillion after ballooning for years. More than 43 million Americans have federal student debt, with almost a third owing less than $10,000 and more than half owing less than $20,000, according to the latest federal data.

The national debt, according to the Treasury Department, currently sits at $30.7 trillion.

The announcement comes as the U.S. is facing record-high inflation. But when asked if the plan would increase inflation, a senior administration official said the steps the Biden administration is taking will offset each other, noting there are “certain conditions and assumptions under which it could well be neutral or deflationary.”

The official said that the “combination” of an extension in the pause in loan payments and the “targeted debt relief” will “largely offset” inflation.

BIDEN STUDENT LOAN HANDOUT TO COST ROUGHLY $500B, ACCORDING TO COMMITTEE FOR A RESPONSIBLE FEDERAL BUDGET

“That’s our view,” the official said, adding that “if all borrowers claim the relief that they are entitled to, 43 million federal student loan borrowers will benefit, and of those, 20 million will have their debt completely canceled.”

And Biden himself claimed that his administration’s move to restart frozen federal student loan payments at the end of the year is an “economically responsible course” that will prevent his targeted student loan cancellation from having a “meaningful effect on inflation.”

The president on Wednesday said that under his new plan, “nearly 45% can have their student debt fully canceled.”

“That’s 20 million people who can start getting on with their lives,” he said.

But the student loan handout doesn’t help all student loan borrowers. Biden said it “only applies to those earning less than $125,000.”

The president also said that borrowers with undergraduate student loans are able to “cap repayment at 5% of your monthly income.”

Pandemic-era payment freezes were set to end on Aug. 31, but Biden on Wednesday also extended the payment pause “one final time through Dec. 31, 2022.”

Read the full article Here